Creating Sinking Funds For Future Expenses With A Cash Envelope System

I don’t usually write about finances, but I’m really loving these new envelopes I got, and I had to share! I’m fairly new to budgeting, but I’ve committed to going all-in this year so I can finally get a handle on things.

I had a really great phone meeting with a financial planner last week, and even though my blog isn’t about finances, I had to tell you guys all about it.

I was nervous going into the meeting, thinking she would pick apart my current way of living (which is having no real plan and just paying for things as they come up). It turns out, I had absolutely nothing to be nervous about. She was so fun to talk to, and we spent most of the session laughing over different budgeting stories we shared.

When we talked about groceries, I told her how I loved using Instacart, and she downloaded the app right then and there to her phone. Instacart is an app to order groceries and other items from. Our city has several stores listed to shop from (Walmart, Superstore, Costco, Sephora, etc). It’s a $10 per month subscription that covers unlimited deliveries, so the only other fee you have to pay is whatever you decide to tip. I love using Instacart because it’s super easy to keep on budget (you can see the total $$ adding up as you add items to your cart), it helps keep me from impulse buying items I don’t need, and it’s nice to shop from the comfort of my own home instead of taking my son out to different stores all the time during a pandemic. I often do my grocery shopping in the morning and set the delivery time for when I come home from work.

One of the things she suggested was creating sinking funds for future expenses. A sinking fund is a savings account (or envelope, jar etc) with one specific category to save towards. I LOVE this idea, because it allows you to prepare for different future events ahead of time so you aren’t suddenly faced with an expense you need to pay for out of pocket or with credit.

I’ve never done sinking funds before BUT I kind of dipped my toe into it with a piggy bank I use to save for Summer vacation. It’s literally just a white piggy bank that I put spare change and bills into. Last year, we were able to save an extra $80 in a few months towards vacation. It was used on gas and food while we were away. I started adding to the piggy bank immediately after last year’s vacation and we have a good amount saved up now.

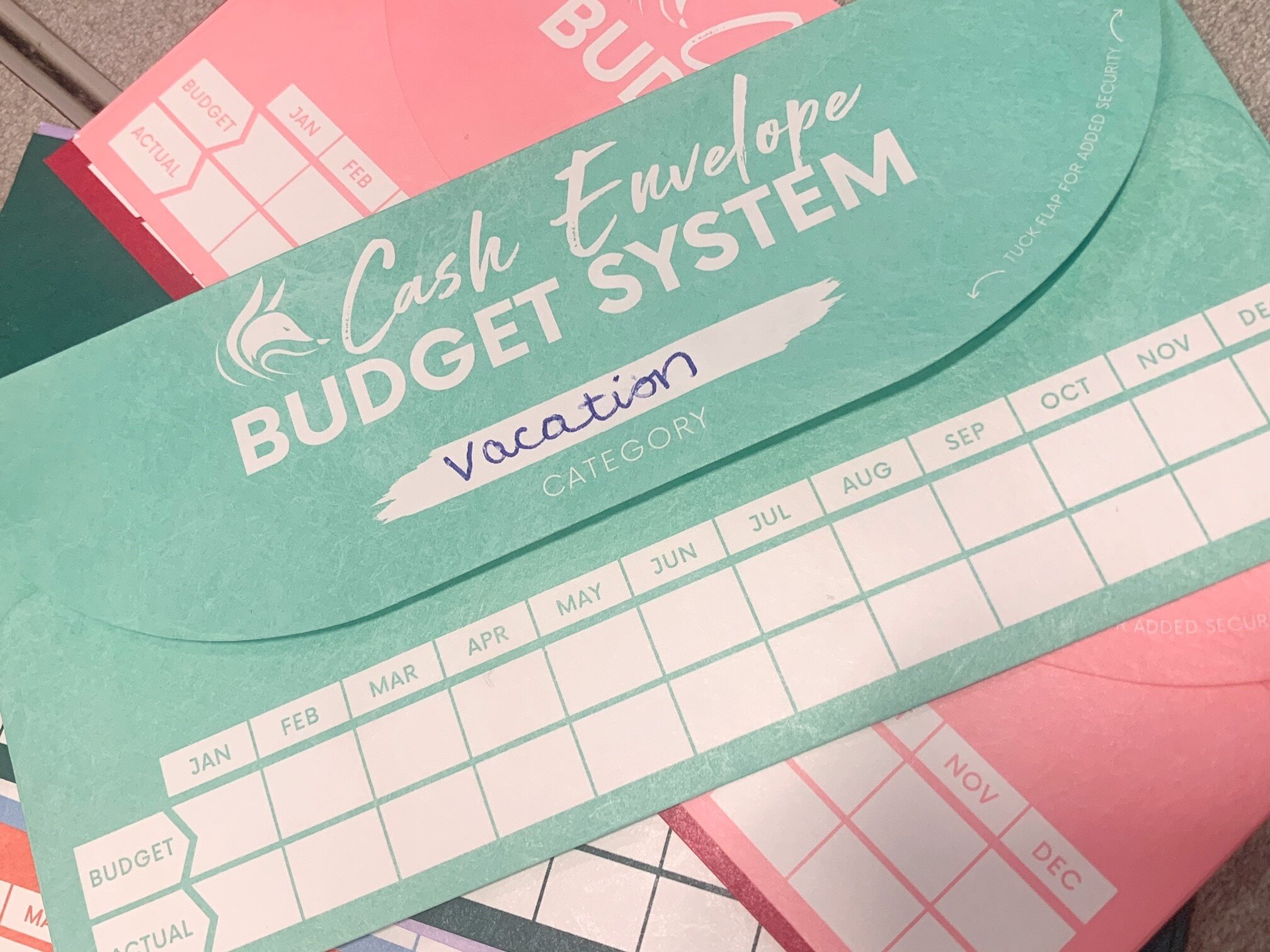

I had an Amazon credit, so I decided to order the Clever Fox money envelope system. It’s 12 tear proof, waterproof envelopes and a zipper carrying case. It’s supposed to come with 12 budgeting sheets as well, but they accidentally sent me 24 envelopes and no budgeting sheets. I’m talking to customer service about this now, but 24 envelopes actually works out better for me since I have a lot of categories I want to save for. Realistically you can use normal envelopes for this without purchasing anything, but I really liked this system, and the quality of the envelopes. ALSO, some people create actual separate no-fee savings accounts for each sinking fund. Personally, I do better with saving cash because I’m not tempted to spend it, where I would be tempted to transfer funds from a savings account.

I’m just using the envelopes for sinking funds, but a lot of people use them for daily expenses as well! Since I pay all of my bills online and order my groceries, it didn’t make sense to use cash for daily expenses- but do what works for you! For larger expenses like saving for a house down payment, I would recommend using a savings account instead of cash.

For adding $$ to sinking funds, it’s important to work it into your monthly budget. Figure out how much money per month you can afford to add, and then decide which category you want to add it to. Look at the entire year, and figure out what predictable expenses will come up (Christmas, sports, back to school etc), and calculate how much to save each month. Also allow savings for unpredictable expenses depending on your categories (car maintenance, etc).

Realistically you most likely won’t be adding funds to every envelope every single month. You’ll add to different envelopes at different times depending on need.

Here are the categories I have for my sinking funds. I have a few left over envelopes for other things that may come up. I’m not going to write the amounts on the envelope as I add funds, because I want to use the same envelopes year after year without repurchasing.

The Holidays - This includes Christmas, New Year’s Eve, etc. I will use this envelope to save for gift money, gas money to drive home, and any dining out we may do over the holidays.

Birthdays - This one is to save for birthday gifts for Mason, and any other family and friends we may need to buy for over the year.

Halloween- I had so many envelopes due to the mix up that I decided to use an orange one for Halloween. If you have less envelopes, this one isn’t really necessary, but I tend to spend a lot around Halloween for costumes, candy, party decor if Mason has a party, gas money to drive to my hometown if we go there, etc.

Easter - Easter can sometimes feel like a second Christmas around here, and it’s so close to Mason’s birthday that I’m always spending a lot around this time. This envelope is to save for candy, Easter decor, and again gas money in case we go to visit the grandparents.

Back To School - This one is SO important, and I feel like it gets overlooked by a lot of parents (based on the social media posts I see every back to school month). I try to start buying things at the beginning of Summer for back to school, or get things on sale as I see them. I also try to buy quality over quantity when it comes to school items. I bought him an LL Bean backpack for Kindergarten, and he’s now on his second year with it. We also have good quality water bottles we’ve been using for a couple of years (with his Mabel’s Labels stickers still attached after a gazillion washes), so those are things I don’t need to replace every single year. I obviously know how exciting it is to get new things for back to school though, so I tend to focus my money on new clothes, a lunch box, accessories etc. His school also has a $50 fee payable the first month of school to go towards classroom supplies, so I budget for that.

Self Care - This one is for haircuts and similar services.

Pet Care - I’ve gone back and forth on buying pet insurance, and for now I’ve decided to just “deposit” the money I would be paying for pet insurance into this envelope to go towards any grooming, vet visits, etc that Jasper or Binx may need.

Vehicle Maintenance - For oil changes, car washes, paying for yearly registration and inspections, tires, etc.

Vacation - This one is for our annual trip to Shediac. My mom is paying for accommodations, so this year it will be for gas, souvenirs, trips to the market, dining out, the drive-in, etc. I labeled it “Vacation” instead of Shediac so I can use it for future trips once the pandemic restrictions are lifted.

Day Trips - I wanted a separate envelope for day trips so I didn’t have to take from the vacation money I’ve been saving. This is for gas, entry fees to attractions and parks, dining out, etc.

Fast Food - I’m trying to make fast food a treat instead of a common occurrence, so I created an envelope for it. I’ll calculate how much I want to spend that month, and once it’s gone, it’s gone.

Entertainment - For going to the movies, entry fees to any local events, etc.

Sports & Activities - To pay for Mason’s soccer fees, swimming lessons, etc.

Tech Repair & Replacement - For replacing screens, chargers, etc. Mason recently fell up the stairs with his iPad and cracked the screen for example, so I’ve set aside money in this envelope for the repair of that.

Mason’s Money - Every time we visit any of the grandparents, Mason usually makes away with a $5 bill or more. This envelope is for that. He has a wallet, so anytime he wants to buy something, he can make a “withdrawal” from the envelope to his wallet.

Furniture & Decor - I used to wander aimlessly around Homesense, but those days are behind me. My house is already FULL of random decor pieces, so instead of buying new, I’m trying to work with what I have.

Medical & Dental - I have a great plan through work (and live in Canada), so this will be for any prescriptions, cold and flu meds, dental and vision balances etc.

Clothes & Shoes- I tend to buy things as they go on sale, or at the end of the season, so this envelope will be towards those purchases, or larger purchases like shoes for myself and Mason, purses, etc.

Spending- For when I want to buy a mug, notebook, and other fun not necessary items.

Where We Summer- I made one for the blog! I pay a small monthly fee to Squarespace to keep my blog and domain email running. I’m also currently working on a “shop” section of the blog where I’m going to be selling some item’s I’ve been working on, so this envelope will also be for supplies for that.

It will be a slow start at first, but I’m looking forward to watching them grow! Much like I did for my vacation fund last year, if you have a once-a-year expense coming up, you can start a whole year in advance. That way you only need to deposit small amounts into your envelopes each month.

Do you use a cash envelope system? What do you use yours for? Comment below!